Share this

Digital disruption - The nature of the firm and the rise of the unicorns

by Mark Smith on 13 November 2015

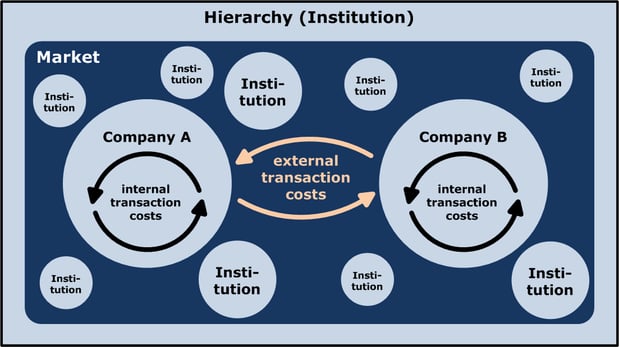

Image: Market-Hierarchy-Model by Grochim, used under CC BY 3.0.

In the previous two articles in this series Digital disruption and other 21st century challenges and Digital disruption - What are we actually talking about? I have clarified that digital disruption is real and that we must as organisations embrace it or risk irrelevancy.

In this article I want to show you how digital disruption is changing the dynamics of organisations. To make my point I first need to take you through a little bit of economic theory, so that we can explore why firms exist in the first place and how digital disruption might change the economics and structure of the firm.

Firms and transaction costs

The Nobel-prize winning economist, Ronald Coase, analysed why an entrepreneur would hire employees in the first place rather than contract with the open market. Coase postulated that firms exist because they are able to maintain lower transaction costs for the development of products and services than the costs for an entrepreneur to contract multiple individuals in the market. Basically firms exist where it is cheaper to develop products and services internally.

Coase stated that:

“Whether a transaction would be organized within a firm or whether it would be carried out on the market depended on a comparison of the costs of organizing such a transaction within the firm with the costs of a market transaction that would accomplish the same result”

Simplifying that down even further, firms existed and grew because they could perform things like production, warehousing, sales and marketing, inventory management, delivery etc at a lower cost internally than externally.

Constraints like geography, logistical efficiency, product development and payment processing were more cost effectively managed within the firm and the same was true of market competitors. Optimisation, process improvement and systems automation were applied to stay ahead of the competition, resulting in growing sophistication of internal systems and increased internal IT capability.

So what has this got to do with digital disruption?

Well, historically, due to technology constraints (networks, servers, desktops etc) work could only be achieved inside the boundaries of the firm (or the data centre). The model could not be disintermediated by the market as every other firm was working with the same constraints.

Customers also lived with those constraints, they were dependent on what the firm told them about their products and services, they needed to visit the shop or store to educate themselves and physical word of mouth had no viral capability.

The impact of digital technology is that now the market can disintermediate the firm, and consumers can sever their dependency on the traditional firm. The parochial information hoarding of the firm is out and peer-to-peer information sharing is in. Traditional middlemen firms are shrinking and retrenching, and newer, leaner middlemen are appearing who are using external market capability, way less internal resource, and direct customer involvement to match and beat traditional firms.

The rise of 'sharing economy companies' and unicorns

The pace of digital change is so rapid that market commentators are inventing new terms to describe the major success stories in the sharing econony. Unicorn is a term coined by seed investor Aileen Lee to describe privately owned startup companies with $1billion plus valuations. Sharing economy unicorns include Uber (sharing alternative to using a Taxi firm), and AirBnB (sharing alternative to using a hotel). When Ms Lee coined the term in 2013, she identified 39 members of the 'Unicorn Club'. Now, according to the Wall Street Journal, there are 125 unicorns and counting.

Closer to home TradeMe, though not a unicorn, has leveraged it's digital platform to provide an alternative to using a retail store, recruitment agent, or real estate agent, and the NZ Herald also recently compared and contrasted Xero to these unicorns.

Regardless of these categorisations the reality is the these newer, leaner digital middlemen use digitisation to cut across traditional organisation and firm boundaries and facilitate sharing and collaboration between external market participants in ways that are deeply disruptive to traditional business models.

Food for thought? – absolutely, and in the next article I’ll be looking at some more specific examples of digital disruption that offer new firms opportunities to enter the market, or that give traditional firms the opportunity to compete differently, to re-envision their products or to re-engage their customers.

Mark Smith is an Equinox IT Principal Consultant based in our Auckland Office who specialises in digital strategy and IT architecture.

Share this

- Agile Development (84)

- Software Development (66)

- Scrum (39)

- Business Analysis (28)

- Agile (27)

- Application Lifecycle Management (26)

- Capability Development (20)

- Requirements (20)

- Solution Architecture (19)

- Lean Software Development (17)

- Digital Disruption (16)

- IT Project (15)

- Project Management (15)

- Coaching (14)

- DevOps (14)

- Equinox IT News (12)

- IT Professional (11)

- Knowledge Sharing (10)

- Strategic Planning (10)

- Agile Transformation (9)

- Digital Transformation (9)

- IT Governance (9)

- International Leaders (9)

- People (9)

- IT Consulting (8)

- AI (7)

- Cloud (7)

- MIT Sloan CISR (7)

- ✨ (7)

- Change Management (6)

- Azure DevOps (5)

- Innovation (5)

- Working from Home (5)

- Business Architecture (4)

- Continuous Integration (4)

- Enterprise Analysis (4)

- FinOps (4)

- Client Briefing Events (3)

- Cloud Value Optimisation (3)

- GitHub (3)

- IT Services (3)

- .Net Core (2)

- Business Rules (2)

- Data Visualisation (2)

- Java Development (2)

- Security (2)

- System Performance (2)

- API (1)

- Automation (1)

- Communities of Practice (1)

- Kanban (1)

- Lean Startup (1)

- Microsoft Azure (1)

- Satir Change Model (1)

- Testing (1)

- January 2026 (2)

- November 2025 (1)

- August 2025 (3)

- July 2025 (3)

- March 2025 (1)

- December 2024 (1)

- August 2024 (1)

- February 2024 (3)

- January 2024 (1)

- September 2023 (2)

- July 2023 (3)

- August 2022 (4)

- July 2021 (1)

- March 2021 (1)

- February 2021 (1)

- November 2020 (2)

- July 2020 (1)

- June 2020 (2)

- May 2020 (2)

- March 2020 (3)

- August 2019 (1)

- July 2019 (2)

- June 2019 (1)

- April 2019 (2)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- April 2018 (2)

- January 2018 (1)

- September 2017 (1)

- July 2017 (1)

- February 2017 (1)

- January 2017 (1)

- October 2016 (2)

- September 2016 (1)

- August 2016 (4)

- July 2016 (3)

- June 2016 (3)

- May 2016 (4)

- April 2016 (5)

- March 2016 (1)

- February 2016 (1)

- January 2016 (1)

- December 2015 (5)

- November 2015 (11)

- October 2015 (3)

- September 2015 (1)

- August 2015 (1)

- July 2015 (7)

- June 2015 (7)

- April 2015 (1)

- March 2015 (2)

- February 2015 (2)

- December 2014 (3)

- September 2014 (2)

- July 2014 (1)

- June 2014 (2)

- May 2014 (8)

- April 2014 (1)

- March 2014 (2)

- February 2014 (2)

- November 2013 (1)

- October 2013 (2)

- September 2013 (2)

- August 2013 (2)

- May 2013 (1)

- April 2013 (3)

- March 2013 (2)

- February 2013 (1)

- January 2013 (1)

- November 2012 (1)

- October 2012 (1)

- September 2012 (1)

- July 2012 (2)

- June 2012 (1)

- May 2012 (1)

- November 2011 (2)

- August 2011 (2)

- July 2011 (3)

- June 2011 (4)

- April 2011 (2)

- February 2011 (1)

- January 2011 (2)

- December 2010 (1)

- November 2010 (1)

- October 2010 (1)

- February 2010 (1)

- July 2009 (1)

- October 2008 (1)