Share this

Understanding the options for the next generation enterprise

by Ian Attwood on 04 September 2013

Dr. Peter Weill, addressing Equinox IT consultants in August, talked about his research into Options for Next Generation Enterprise.

Dr. Weill is Chairman and Senior Research Scientist for the MIT Sloan Center for Information Systems Research (CISR). He was in Wellington as a guest of Equinox IT and spoke with government, Wellington City Council, and business leaders about CISR's research into why enterprises will need to be either drivers or participants in several digital ecosystems, and a driver in at least one to survive.

He discussed CISR’s research methodologies and said creating the framework for researchingOptions for the Next Generation Enterprise had been extremely difficult.

“We do a lot of interviews and research to come up with the dimensions we think will be important in predicting the future of business. The dimension that took us by surprise (and in hindsight shouldn’t have) was the value in knowing your end consumer. More specifically, we believe knowing your customer’s goals makes a key difference,” said Dr. Weill.

© 2013 MIT Sloan CISR-Weill, Woerner

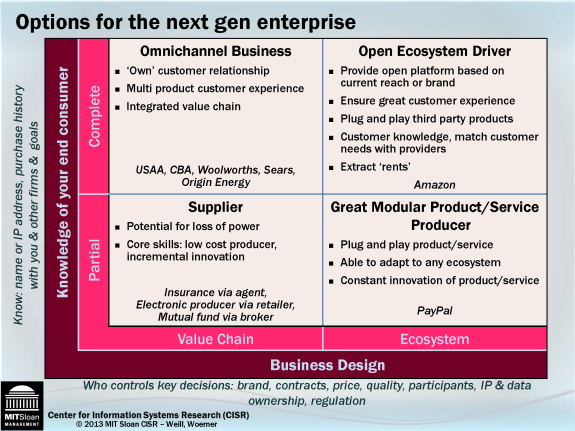

He said the Options framework was based upon two axes: Business Design—the value chain ecosystem; and Knowledge of Your End Customer. CISR research in turn generated the four quadrants: Omnichannel Business (e.g. USAA, Woolworths Australia, Coles Australia); Open Ecosystem Driver e.g. (Amazon); Great Modular Product/ Service Producer (e.g. PayPal); andSupplier (e.g. purchasing insurance via an agent).

“CISR’s research indicated that when margins are low, organisations become under pressure and seek to move out of their quadrant.

“Most companies who are multi-channel are trying (and this is a big, difficult change) to become omnichannel businesses offering a multi-product client experience.

“Our research shows organisations in the Supplier quadrant wanting to move up, and businesses currently in the Omnichannel Business quadrant seeking to move right towards an Open Ecosystem Driver. Huge investments are now being made to move within these axes.

“The exception is an organisation such as PayPal which has determined to be the best in the world at one thing, and plug-and-play in anyone else’s’ ecosystem,” said Dr. Weill.

Assessing the options

One way you can measure your options is to bring the Voice of the Customer inside your company said Dr Weill.

He referenced the USA Net Promoter Score (NPS) 2013 benchmarking survey which noted the average Financial Services industry ranking for banks was 29%. In other words 29% of customers would net promote their bank to their friends. The United States Automobile Association (USAA) ranked first in this category with 78% in the 2013 survey. Significantly USAA also led the Select Insurance sector with an 80% approval ranking for their home content insurance.

Amazon was by far the highest-ranking organisation in the Online Services sector with a NPS ranking of 69% outstripped bricks and mortar retailers.

Dr. Weill, looking at USAA’s NPS performances and paraphrasing Bill Gates’ famous quote, said “We all need banking. I’m just not convinced we need banks.”

USAA’s results also supported, he said, CISR’s July 2013 Research Briefing that companies with better digital business models have higher financial performance. CISR found that enterprises with above-average digital business effectiveness had revenue growth eleven percentage points higher than their industry average.

An Australasian context

Dr. Weill said that Coles, the supermarket chain, is now one of the larger insurance players in Australia.

“They’ve added insurance to their customer experience and the relationship they already have with you.”

As well as owning Coles, parent company Wesfarmers also owns Bunnings, Target, Kmart and Officeworks, together with substantial coal, chemicals and insurance operations.

"Wesfarmers is now a diversified mining, energy, retail, insurance and agricultural corporation that has successfully expanded its insurance business through the relationships customers have with Coles," said Dr. Weill.

More

Read Tom Pullar-Strecker’s September Dominion Post story about USAA’s car purchase digital ecosystem.

Share this

- Agile Development (84)

- Software Development (66)

- Scrum (39)

- Business Analysis (28)

- Agile (27)

- Application Lifecycle Management (26)

- Capability Development (20)

- Requirements (20)

- Solution Architecture (19)

- Lean Software Development (17)

- Digital Disruption (16)

- IT Project (15)

- Project Management (15)

- Coaching (14)

- DevOps (14)

- Equinox IT News (12)

- IT Professional (11)

- Knowledge Sharing (10)

- Strategic Planning (10)

- Agile Transformation (9)

- Digital Transformation (9)

- IT Governance (9)

- International Leaders (9)

- People (9)

- IT Consulting (8)

- AI (7)

- Cloud (7)

- MIT Sloan CISR (7)

- ✨ (7)

- Change Management (6)

- Azure DevOps (5)

- Innovation (5)

- Working from Home (5)

- Business Architecture (4)

- Continuous Integration (4)

- Enterprise Analysis (4)

- FinOps (4)

- Client Briefing Events (3)

- Cloud Value Optimisation (3)

- GitHub (3)

- IT Services (3)

- .Net Core (2)

- Business Rules (2)

- Data Visualisation (2)

- Java Development (2)

- Security (2)

- System Performance (2)

- API (1)

- Automation (1)

- Communities of Practice (1)

- Kanban (1)

- Lean Startup (1)

- Microsoft Azure (1)

- Satir Change Model (1)

- Testing (1)

- January 2026 (2)

- November 2025 (1)

- August 2025 (3)

- July 2025 (3)

- March 2025 (1)

- December 2024 (1)

- August 2024 (1)

- February 2024 (3)

- January 2024 (1)

- September 2023 (2)

- July 2023 (3)

- August 2022 (4)

- July 2021 (1)

- March 2021 (1)

- February 2021 (1)

- November 2020 (2)

- July 2020 (1)

- June 2020 (2)

- May 2020 (2)

- March 2020 (3)

- August 2019 (1)

- July 2019 (2)

- June 2019 (1)

- April 2019 (2)

- October 2018 (1)

- August 2018 (1)

- July 2018 (1)

- April 2018 (2)

- January 2018 (1)

- September 2017 (1)

- July 2017 (1)

- February 2017 (1)

- January 2017 (1)

- October 2016 (2)

- September 2016 (1)

- August 2016 (4)

- July 2016 (3)

- June 2016 (3)

- May 2016 (4)

- April 2016 (5)

- March 2016 (1)

- February 2016 (1)

- January 2016 (1)

- December 2015 (5)

- November 2015 (11)

- October 2015 (3)

- September 2015 (1)

- August 2015 (1)

- July 2015 (7)

- June 2015 (7)

- April 2015 (1)

- March 2015 (2)

- February 2015 (2)

- December 2014 (3)

- September 2014 (2)

- July 2014 (1)

- June 2014 (2)

- May 2014 (8)

- April 2014 (1)

- March 2014 (2)

- February 2014 (2)

- November 2013 (1)

- October 2013 (2)

- September 2013 (2)

- August 2013 (2)

- May 2013 (1)

- April 2013 (3)

- March 2013 (2)

- February 2013 (1)

- January 2013 (1)

- November 2012 (1)

- October 2012 (1)

- September 2012 (1)

- July 2012 (2)

- June 2012 (1)

- May 2012 (1)

- November 2011 (2)

- August 2011 (2)

- July 2011 (3)

- June 2011 (4)

- April 2011 (2)

- February 2011 (1)

- January 2011 (2)

- December 2010 (1)

- November 2010 (1)

- October 2010 (1)

- February 2010 (1)

- July 2009 (1)

- October 2008 (1)